Leveraging Liquidity

nobi

nobicute & punk rock @floordao @punkrockfi

Leveraging Liquidity is Cute, it's Punk Rock

Liquidity as an Oasis

In the burgeoning NFT-Fi market, liquidity is an oasis. The availability of deep, instant liquidity is a critical factor in an asset's success or failure, as capital is always flowing in and out of the thousands of projects launched as NFTs, never returning to most. This fight for liquidity is one that all collections face, and Punk Rock Capital has identified itself as a proactive liquidity provider primarily targeting Remilia Collective’s collections (YAYO NFT, Milady Maker, Redacted Remilio Babies).

At Punk Rock Capital, our approach is straightforward yet impactful. We’ve aligned ourselves with the Remilia Collective, which has already started to leverage the governance system of FloorDAO with the purchase of over $40,000 worth of FloorDAO governance tokens. This is achieved through a series of votes known as the Floor Wars, where gFLOOR (Governance FLOOR) token holders collectively decide which NFT collections will be swept.

Historical NFT Liquidity Pool Success

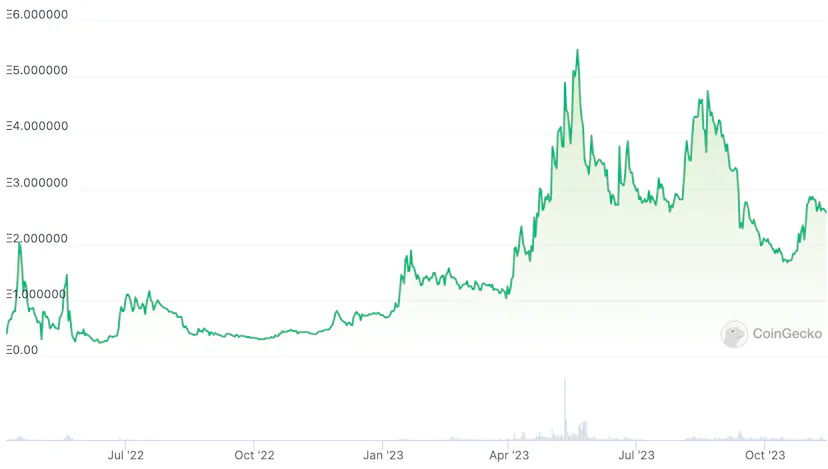

There has been no greater case to prove the effectiveness of passive liquidity provision than that of FloorDAO’s Milady Maker NFTX pool. Floor’s acquisition of Milady serves as a perfect example of the NFT market's flight to liquidity in times of uncertainty; when Floor integrated Milady Maker into its treasury, the move was met with speculators eager to sell their Miladys into a FloorDAO mega-sweep.

The DAO held strong, passively earning fees and experimenting with the newly added liquidity, even opening bonds to receive more Milady Maker NFTs. The bliss lasted for a few days before a Tweet thread by @0xngmi on Remilia Collective’s assumed past caused a significant drop in the collection's market price.

In the hours following the thread’s release, CT rapidly shifted from embracing Milady to casting her aside and rejecting her. The sales intensified, pushing Milady's floor down from nearly 2 ETH to less than 0.25 ETH. And then the network rebounded.

The @0xngmi thread was posted in July, 2022. Milady fell to 0.24 ETH and rebounded to over 5.5 ETH less than a year later. FloorDAO earned fees all the way down from 2 ETH down to 0.24 ETH, and up to 5.5 ETH.

The NFTX pool that Floor set up acted as an eternal buy wall - hundreds of Miladys were swapped for instant ETH liquidity on NFTX. As this ETH was supplied by Floor, the FloorDAO treasury earned yield. Over the 24 hours that Milady was betrayed and her public trial began, Floor had farmed over 1% of the Milady Maker supply in trading fees on NFTX. FloorDAO was now the largest holder of Milady NFTs.

How Will Punk Rock Capital Benefit From This Model?

Based on Floor’s model of passive liquidity provision, Punk Rock Capital plans to establish an initial YAYO NFT pool on NFTX, as well as creating permanent buy-walls for YAYO on sudoswap. By strategically deploying funds to purchase NFTs and establishing liquidity pools, we’re not merely reacting to market shifts but actively shaping the liquidity landscape.

We plan to allocate a large portion of mint funds towards this end, ensuring that collections like YAYO not only receive immediate support in the form of liquidity, but also have consistent, enduring liquidity.

Leveraging FloorDAO Votes For Weekly Sweeps

Punk Rock Capital ↗ plans to take a key role in FloorDAO governance, aiming to use FloorDAO's influence to steer liquidity towards select NFT collections. We’ll participate in Floor V2’s weekly votes that will result in the allocation of ETH to sweep Milady and Remilio NFTs, thereby enhancing their market value and liquidity. Punk Rock Capital is committed to providing deep, permanent liquidity - specifically for Remilia NFT projects, establishing robust liquidity pools on NFTX and sudoswap, and prioritizing the sweeping of the YAYO NFT collection.

The future is bulletproof. 💫